Get the free irs form 990 n postcard

Get, Create, Make and Sign

How to edit irs form 990 n postcard online

How to fill out irs form 990 n

How to fill out form 990 n e:

Who needs form 990 n e:

Video instructions and help with filling out and completing irs form 990 n postcard

Instructions and Help about form tax 990n

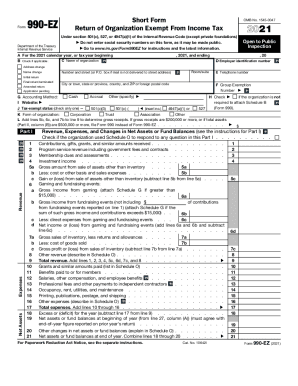

Welcome to Express tax-exempt the home for all of your tax-exempt filing needs we're here to help by offering a quick and simple solution to e-file your tax-exempt forms the 990-n also known as the e postcard as an electronic notice sent to the IRS by small exempt organizations and charities that typically receive $50,000 or less per year in gross receipts the deadline to file the form 990-n is the 15th day of the fifth month after the last day of your tax year the due date falls on May 15th for organizations that use the calendar year January 1st to December 31st as their fiscal year if you miss the deadline for filing the form 990-n you may receive a reminder in the mail from the IRS, but you will not be assessed a penalty for filing late an organization that fails to file its 990-n for three consecutive years will automatically lose the tax-exempt status not much is required to file the form 990-n you'll just need to be prepared with the following information your employer identification number or and also known as your tax ID or TI n your tax year the legal name and address of your organization including the different names of the organization may use the name and address of a principal officer and the confirmation that your gross receipts are $50,000 or less the best way to file the form 990-n is through the IRS authorized e-file provider express tax-exempt com simply create your free account enter your organization's information choose the tax year confirm your gross receipts and transmit it to the IRS will automatically receive your form and will email you shortly after to confirm that your return has indeed been accepted filing your taxes shouldn't have to be difficult and with Express tax-exempt it isn't but if you do need any help our dedicated us-based support team in Rock Hill South Carolina is happy to assist we offer live phone and chat support Monday through Friday from 9:00 a.m. until 6:00 p.m. Eastern Time and 24/7 email support so don't hesitate and give us a call, or you can email us at support that expressed tax-exempt calm if you have any questions.

Fill 990n tax form : Try Risk Free

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 990 n online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.